Stablecoins Demystified: Collateralized vs Algorithmic

What Are Stablecoins?

Stablecoins are a type of digital money. They are designed to keep a stable value. This makes them different from other cryptocurrencies like Bitcoin.

People use stablecoins for many reasons. They can buy things, trade, or save money. Stablecoins are often tied to real-world assets.

Types of Stablecoins

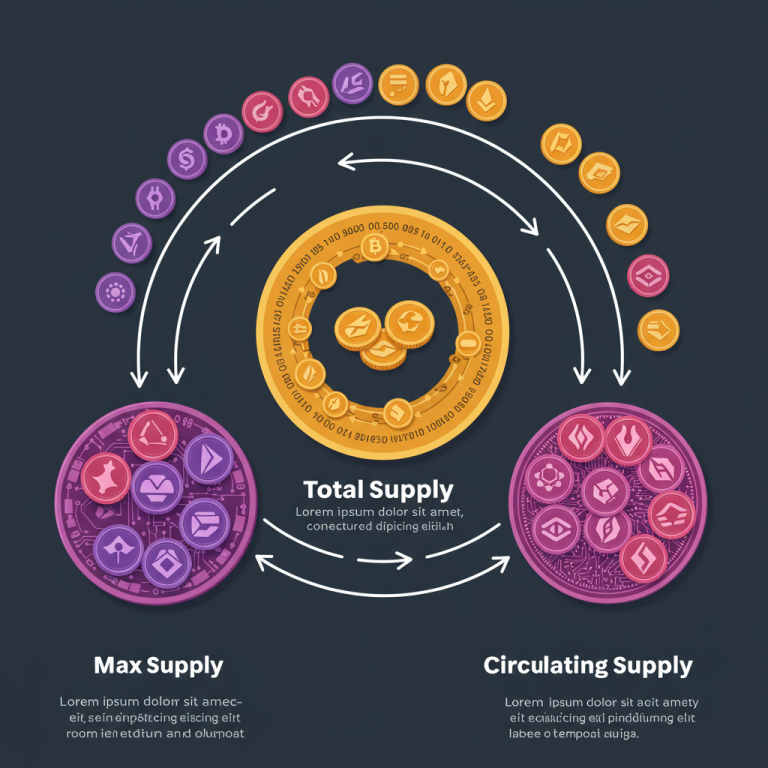

There are mainly two types of stablecoins: collateralized and algorithmic. Each type works in a different way.

Collateralized Stablecoins

Collateralized stablecoins are backed by real assets. These assets can be money or other valuables. When you buy a collateralized stablecoin, you know what it is worth.

For example, one stablecoin might be worth one US dollar. This is because it is backed by one dollar in a bank. If you want to redeem your stablecoin, you can get your dollar back.

Algorithmic Stablecoins

Algorithmic stablecoins do not need real assets. Instead, they use smart contracts and algorithms. These help keep the price stable.

If the price goes too high, the system creates more coins. If the price drops, it takes coins away. This way, the price stays close to a certain value.

How They Work

Let’s look at how collateralized and algorithmic stablecoins work.

| Feature | Collateralized Stablecoins | Algorithmic Stablecoins |

|---|---|---|

| Backing | Real assets (like cash) | No real assets |

| Price Stability | Stable due to backing | Stable due to algorithms |

| Redemption | Can get back real assets | No real assets to redeem |

| Risk | Lower risk | Higher risk |

Benefits of Stablecoins

Stablecoins have many benefits. Here are some of them:

- Stable value helps in trading.

- Easy to use for payments.

- Can be used to save money without losing value.

- Fast transactions compared to banks.

Risks of Stablecoins

Even with benefits, stablecoins have risks. Here are some risks to consider:

- Collateralized stablecoins can lose value if the backing is lost.

- Algorithmic stablecoins can be unstable if the system fails.

- Regulations may change, affecting how stablecoins work.

Conclusion

Stablecoins are an interesting part of the digital money world. They can help people buy, trade, and save money. Understanding the difference between collateralized and algorithmic stablecoins is important.

Both types have their own benefits and risks. Choose wisely based on your needs.

FAQ

What is a stablecoin?

A stablecoin is a type of digital currency that keeps a stable value. It is often backed by real assets.

What is the difference between collateralized and algorithmic stablecoins?

Collateralized stablecoins are backed by real assets, while algorithmic stablecoins use algorithms to maintain their value.

Are stablecoins safe to use?

Stablecoins can be safe, but they have risks. Always do your research before using them.

Stablecoins help people manage their money in the digital world.